How Artificial Intelligence Will Disrupt the Financial Sector

Artificial intelligence thrives with data. The more data you have, the better your algorithms will be. However, just having a lot of data is not sufficient anymore. You also need high-quality data, or in the words of Peter Norvig, you need better data:

“We don’t have better algorithms, we just have more data. More data beats clever algorithm, but better data beats more data.” – Peter Norvig – Director of Research, Google

Nowadays, most organisations collect vast troves of data, but especially the financial sector is well-suited for also collecting high-quality data. Simply because of regulations and because a lot of data in the financial sector is structured data. There is also an abundance of data in public markets or other external sources that can be linked for additional insights. As it seems, banks and insurance companies can benefit a lot from AI, if implemented correctly, of course.

Financial Institutions Have to Innovate

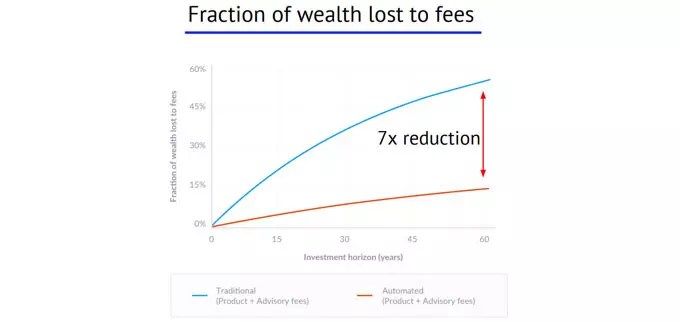

Besides, more and more consumers require financial institutions to innovate. They have become fatigued with overbearing fees to their manage capital and provide products such as credit. The below graph by State of AI clearly shows the difference in costs between traditionally managed wealth and automated management of wealth. As a result, the financial sector faces pressure (not only by customers but also by their shareholders) to reduce their operating expenses by adopting automation.

Source: State of AI.

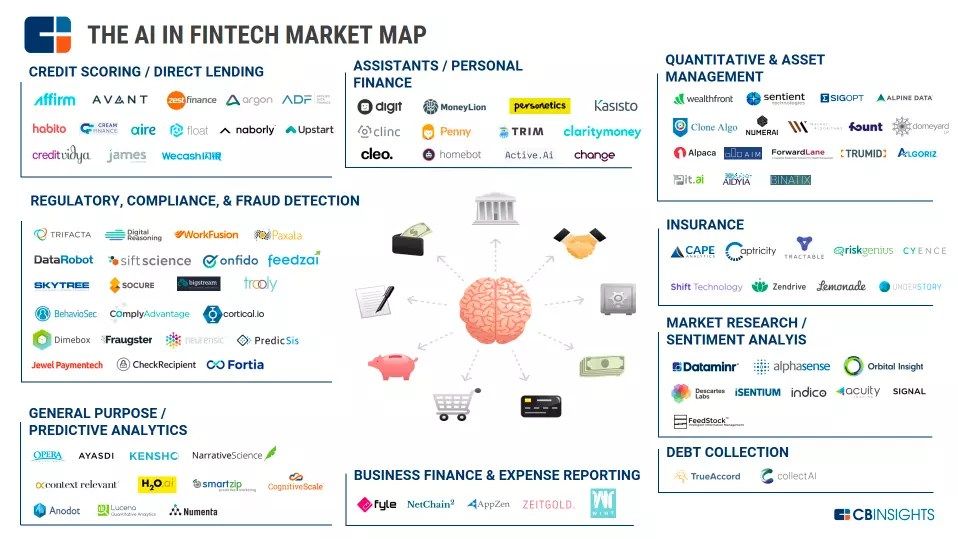

There is no time to waste for incumbent financial institutions, as there are a plethora of new startups entering the market that have a data-first approach, see the below infographic by CBInsights. These new companies are at first data organisations, embedding smartness in every process and customer touchpoint of their organisation. As a result, they are a lot more efficient, lean and often offer a better service at a lower price point. If financial institutions want to prevent becoming the next Kodak or Blockbuster, they should start to innovate and automate.

Source: CBInsights

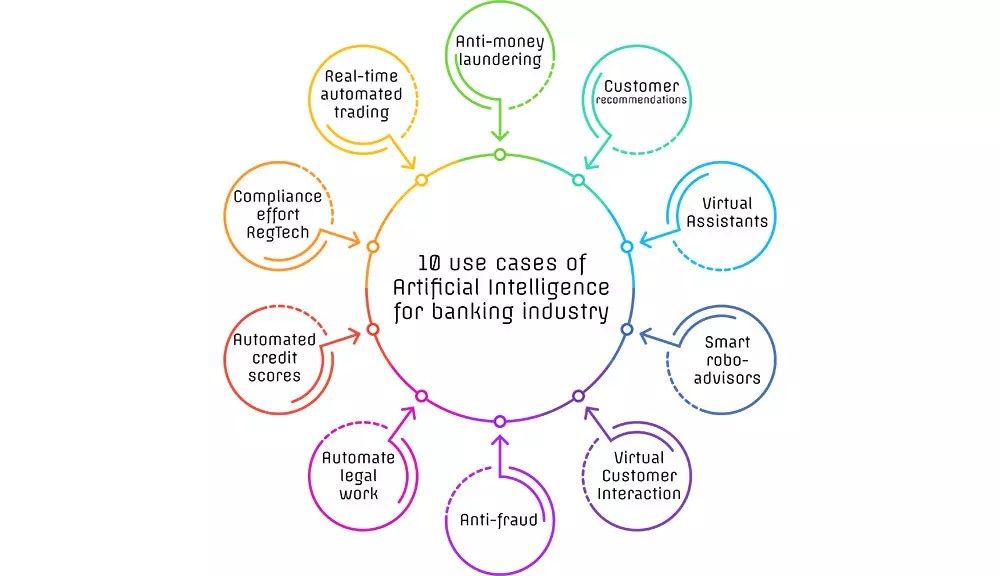

10 Use Case of AI for Banking

Fortunately, there are plenty of opportunities for financial institutions to innovate using artificial intelligence. Financial institutions have to put their data to work and embed smartness in their organisation. Every process and customer touchpoint can and should be automated within, for example, banks. Of course, there are probably many more use cases of AI for the banking industry, but the below infographic showcases ten opportunities:

- Real-time automated trading: automated trading has been around for a while now and has proven to be very beneficial to those who use it.

- Compliance effort RegTech: a considerable part of the compliance function can be automated using AI and machine learning. For example, AI can be applied to the KYC processes by using Natural Language Processing (NLP) to find and identify relevant information.

- Automated credit scores: banks can use credit scorecards and decision parameters to assess risks automatically. As such, simple decisions can be automated, while humans can focus on high-risk decisions.

- Automate legal work: A large chunk of legal work is finding the right sources or documents. This information can be automated using advanced search capabilities.

- Anti–fraud: banks can use machine learning to detect and recognised patterns indicating fraudulent activities. These can then be stopped before happening.

- Virtual customer interaction: the virtual bank branch is growing in importance, and increasingly, banks use AI to interact with (potential) customers digitally instead of face-to-face.

- Smart robo–advisors: robo-advisors can help clients set financial goals, save money, monitor progress or recommend the right product.

- Virtual assistants: chatbots are becoming more important as they can make banks more customer-friendly while reducing call centre costs.

- Customer recommendations: recommender systems have been around for a while, and with the right data, banks can become better at recommending the right product to the right customer.

- Anti–money laundering: preventing money laundering requires banks to sift through millions of transactions and finding the right transaction indicating money laundering. Such pattern recognition or outlier detection is perfectly suited for AI.

As can be seen from this list, there are plenty of opportunities for banks to incorporate artificial intelligence. Let’s select three use cases and dive into them a bit more, with some examples of organisations benefitting from artificial intelligence.

Three Examples of AI in Finance

1. Smart robo-advisors for wealth management

Services such as capital management, tax optimisation and portfolio construction are often done by, expensive, human advisors. However, software-driven automation of these processes can greatly reduce the fees for consumers. Many organisations are implementing robo-advisors in their services, including Wealthfront and Betterment:

Wealthfront: the robo-advisors of Wealthfront use artificial intelligence to manage $3 billion in assets. The AI can track account activity and automatically apply your behaviour on the advice the robot gives you. They also offer forecasts that predict your net worth if you keep investing over long periods of time. In addition, the AI looks for hidden fees and cash drag to optimise your returns.

Betterment: an online investment platform and robo-advisor that uses artificial intelligence to automate investment portfolios and to improve back-office tasks including check processing. Betterment aims to automate the best practices of their best human investors and offer these to their customers at a much lower rate than human fund managers. They want to enhance the customer interaction channels using AI, but also do not which to lose the human touch. Therefore, the vow that AI should complement humans, not replace them.

2. Credits/Loans and Reducing Risk

Calculating and underwriting credit risks can be significantly reduced using artificial intelligence and machine learning. By incorporating multiple internal and external high-quality data sources, it becomes possible to have a better understanding of the person or company applying for a loan. Often, many more variables affect someone’s creditworthiness, which is often lost in manually determining credit risk. AI can result in giving credit to users who usually are not eligible, whether through peer-to-peer or directly.

Lending Club uses artificial intelligence to create a detailed borrower and lender profile and match the two parties. AI is also used to constantly update loan pricing to make sure that the borrower and lender receive the best price. As a result, Lending Club is capable of giving credit to users who normally would face difficulties in obtaining a loan.

AvantCredit uses big data and machine learning algorithms to find patterns and trends to move away from a one-size-fits-all credit model. Instead, they can offer competitive rates and tailor-made loans on an individual basis.

3. Fraud prevention

Finding fraudulent transactions is very important for financial institutions as fraudulent transactions are expensive. That is why banks use both supervised and unsupervised learning to discover known and novel fraudulent behaviours in electronic transactions, interpersonal communications, and claims images. The better financial institutions can detect fraud, the more money they can save.

Ravelin combines various AI techniques to make highly accurate predictions about ongoing events and transactions across the world. They use artificial intelligence to find patterns and outliers in large data volumes. Using reinforcement learning, they constantly improve the algorithms, resulting in rapidly finding and stopping fraudulent transactions. They combine human insights and machine learning to prevent chargebacks, fraud and account takeovers. They are thereby reducing the risks to online businesses.

Tractable develops AI that can learn and perform visual tasks, just like humans can when disaster strikes. They focus especially on using AI to improve damage appraisal. The insurance company uses AI to speed up the process when its customers need money the most. Using visual recognition, they can quickly assess damage to a car, house or crop, unlock the funds and help their customer. Tractable uses image classification to enable instant appraisal and fast recovery.

The future of finance has only just begun

The financial world relies on tailor-made solutions. Every private customer or enterprise is in a different situation, and a mass market approach does not work. Therefore, banks and insurance companies have long relied on human advisors to do the work. However, with the rapid advancements of AI, many of these tasks can now be automated. With machine learning, every customer can have their own private adviser, offering advice completely tailored to their unique situation. With the industry creating and collecting vast troves of data, artificial intelligence is the future of finance.

Cover image: Siberian Art/Shutterstock